Business

How to tax popcorn? India’s formula sparks outrage against GST system

India’s move to tax popcorn differently based on its sugar or spice content has drawn criticism from the opposition and sparked social media outrage, with two former government economic advisers questioning the tax system introduced in 2017.

The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representatives, announced on Saturday that non-branded popcorn mixed with salt and spices would attract a 5% GST, pre-packaged and branded popcorn 12%, and caramel popcorn, categorised as a sugar confectionery, 18%.

The differential rates come into effect immediately, ending confusion over rates as popcorn was taxed differently across states.

Explaining the rationale behind the decision to tax caramel popcorn at 18%, Finance Minister Nirmala Sitharaman said that any product with added sugar is taxed differently.

The announcement, however, sparked a social media storm on Sunday, with opposition politicians, economists and supporters of Prime Minister Narendra Modi’s government criticising the move and others creating memes and poking fun at it.

“Complexity is a bureaucrat’s delight and citizens’ nightmare,” India’s previous Chief Economic Adviser K V Subramanian wrote on X. He questioned the rationale of the decision he said will contribute minimally to tax revenues, but inconvenience citizens.

His predecessor, Arvind Subramanian, said “the folly is compounded because instead of at least moving in the direction of simplicity we are veering to greater complexity, difficulty of enforcement and just irrationality”.

One widely circulated post on X showed an image of a branded “salt caramel” popcorn packet and said how it would send the taxman into a tizzy calculating the tax rate on it.

Jairam Ramesh, leader and spokesman of the main opposition Congress party, said the “absurdity of three different tax slabs for popcorn under GST … only brings to light a deeper issue that the growing complexity of a system that was supposed to be a Good and Simple Tax”.

A finance ministry spokesperson, the GST Council Secretariat and a spokesman for the ruling Bharatiya Janata Party did not respond to requests for comment on the controversy.

The GST system has run into similar controversies for its tax classifications in the past and faced questions although not on this scale.

Previous controversies have involved taxing chapatis or unleavened Indian flatbread differently from layered flatbreads, different rates for curd and yogurt, and cream bun versus bun and cream served separately.

Business

China plans record $411 billion special treasury bond issuance next year

Chinese authorities have agreed to issue 3 trillion yuan ($411 billion) worth of special treasury bonds next year, two sources said, which would be the highest on record, as Beijing ramps up fiscal stimulus to revive a faltering economy.

The plan for 2025 sovereign debt issuance would be a sharp increase from this year’s 1 trillion yuan and comes as Beijing moves to soften the blow from an expected increase in US tariffs on Chinese imports when Donald Trump takes office in January.

The proceeds will be targeted at boosting consumption via subsidy programmes, equipment upgrades by businesses and funding investments in innovation-driven advanced sectors, among other initiatives, said the sources.

The sources, who have knowledge of the discussions, declined to be identified due to sensitivity of the matter.

The State Council Information Office, which handles media queries on behalf of the government, the finance ministry and the National Development and Reform Commission (NDRC), did not immediately respond to a Reuters request for comment.

China’s 10-year and 30-year treasury yields rose 1 basis point (bp) and 2 bps, respectively, after the news.

The planned special treasury bond issuance next year would be the largest on record and underscores Beijing’s willingness to go even deeper into debt to counter deflationary forces in the world’s second-largest economy.

The issuance “exceeded market expectations,” said Tommy Xie, head of Asia Macro research at OCBC Bank.

“Furthermore, as the central government is the only entity with meaningful capacity for additional leverage, any bond issuance at the central level is perceived as a positive development, likely providing incremental support for growth.”

China does not generally include ultra-long special bonds in annual budget plans, as it sees the instruments as an extraordinary measure to raise proceeds for specific projects or policy goals as needed.

As part of next year’s plan, about 1.3 trillion yuan to be raised through long-term special treasury bonds would fund “two major” and “two new” programmes, said the sources with knowledge of the matter.

The “new” initiatives consist of a subsidy programme for durable goods, allowing consumers to trade in old cars or appliances and buy new ones at a discount, and a separate one that subsidises large-scale equipment upgrades for businesses.

The “major” programmes refer to projects that implement national strategies such as construction of railways, airports and farmland and build security capacity in key areas, according to official documents.

The state planner NDRC said on Dec. 13 Beijing had fully allocated all proceeds from this year’s 1 trillion yuan in ultra-long special treasury bonds, with about 70% of proceeds financing the “two major” projects and the remainder going towards the “two new” schemes.

TARIFFS THREAT

Another big portion of the planned proceeds for next year would be for investments in “new productive forces”, Beijing’s shorthand for advanced manufacturing, such as electric vehicles, robotics, semiconductors and green energy, the sources said.

One of the sources said more than 1 trillion yuan would be earmarked for that initiative. The rest would go to recapitalise large state banks, said the sources, as top lenders struggle with shrinking margins, faltering profits and rising bad loans.

The issuance of new special treasury debt next year would equate to 2.4% of 2023 gross domestic product (GDP). Beijing raised 1.55 trillion yuan via such bonds in 2007, or 5.7% of economic output at that time.

President Xi Jinping gathered with top officials for the annual Central Economic Work Conference (CEWC) on Dec. 11 and 12 to chart the economic course for 2025.

A state media summary of the meeting said it was “necessary to maintain steady economic growth”, raise the fiscal deficit ratio and issue more government debt next year, but did not give specifics.

Last week Reuters reported, citing sources, that China plans to raise the budget deficit to a record 4% of GDP next year and maintain an economic growth target of bout 5%.

At the CEWC, Beijing sets targets for economic growth, the budget deficit, debt issuance and other areas in the year ahead.

Though usually agreed by top officials, such targets are not officially unveiled until an annual parliament meet in March and could still change before then.

China’s economy has struggled this year due to a severe property crisis, high local government debt and weak consumer demand. Exports, one of the few bright spots, could soon face US tariffs in excess of 60% if Trump delivers on campaign pledges.

While the risks to exports mean China will need to rely on domestic sources of growth, consumers are feeling less wealthy due to falling property prices and minimal social welfare. Weak household demand also poses a key risk.

Last week, officials said Beijing plans to expand the consumer goods and industrial equipment trade-in programmes.

Business

China to ramp up fiscal support for consumption next year

China will ramp up fiscal support for consumption next year by raising pensions and medical insurance subsidies for residents as well as expanding consumer goods trade-ins, its finance ministry said on Tuesday.

The country will boost the basic pension for retirees and for urban and rural residents and raise financial subsidy standards for urban and rural residents’ medical insurance to help “vigorously” boost consumption, the ministry said after concluding a two-day national fiscal work conference.

China will also intensify support for consumer goods trade-ins and expand effective investment and drive more social investment through government investment, the ministry said.

The measures will improve people’s livelihoods and the policy system to support population growth as well as strengthen the social security network and health care system, it said.

Fiscal spending will enhance technological innovation capabilities and fully support the research and development of key core technologies and promote industrial upgrading, the ministry added.

At an agenda-setting meeting this month, Chinese leaders pledged to increase the budget deficit, issue more debt and loosen monetary policy to maintain a stable economic growth rate as it girds for more trade tensions with the U.S. when Donald Trump returns to the White House.

Chinese authorities have agreed to issue 3 trillion yuan ($411.04 billion) worth of special treasury bonds next year, Reuters reported on Tuesday, citing two sources. That would be the highest on record as Beijing ramps up fiscal stimulus to revive a faltering economy.

Thanks to gains in many of the Magnificent Seven tech stocks.

Reuters reported last week that Chinese leaders have agreed to raise the budget deficit to 4% of the gross domestic product next year, its highest on record while maintaining an economic growth target of around 5%.

($1 = 7.2985 Chinese yuan renminbi)

Business

Dollar holds firm as US rates outlook still dominates

The dollar defended its recent dominance on Tuesday in a holiday-lined week, as investors considered the prospect of higher-for-longer US interest rates, leaving other major currencies struggling near milestone lows.

The US dollar has leaped ahead over the past three months against a basket of currencies, fuelled by diverging central bank outlooks.

After its policy meeting on Wednesday, the U.S. Federal Reserve now looks set to hold rates higher for longer than markets had expected, elevating U.S. Treasury yields and sending the currency 1.2% up to two-year peaks.

Trading volumes are likely to thin out this week as the year-end approaches and major economic data releases are scarce, meaning the rates theme is likely to remain the main driver of moves in the foreign exchange market.

The dollar index held up firm on the day, 0.1% higher at 108.2, still hovering close to the two-year high of 108.54 it reached on Friday.

Other currencies took a breather on Tuesday, but the impact of the dollar’s recent rally was still felt across the board.

The euro was last bought at $1.0393, slightly lower on the day and not far from November’s two-year low, while sterling hovered around a one-month low at $1.2532.

Elsewhere, the yen was pinned near a five-month low and last stood at 157.04 per dollar, having already fallen close to 5% this month into territory that is keeping traders on alert for any intervention from Japanese authorities.

The Bank of Japan (BOJ) last week kept rates on hold and stayed vague on when it could next raise them. The central bank communication stood in stark contrast to the Federal Reserve’s hawkish tone a day earlier, when it projected a measured pace of rate cuts in 2025, sending the yen sliding.

“The shifts in Fed-BOJ policy divergence are now more likely to weaken the JPY,” said Vishnu Varathan, head of macro research for Asia ex-Japan at Mizuho Bank.

“JPY carry trades could, in defiance of a step-up in volatility or uncertainty, remain in play as two critical factors – supported ‘carry returns’ and mitigated capital risks of JPY squeeze – conspire favourably.”

Down Under, the Australian dollar eased 0.19% to $0.6237, while the New Zealand dollar dipped 0.16% to $0.5641.

The Reserve Bank of Australia (RBA) released the minutes of its December policy meeting on Tuesday, which signalled the central bank was closer to cutting interest rates, but needed the flow of economic news to support its confidence that inflation was slowing.

DOLLAR AHEAD

The greenback looked set to end the year more than 6% higher, after falling back last year.

While a benign U.S. inflation reading on Friday eased concerns about the pace of Fed cuts next year, markets are still pricing in just about 35 basis points worth of easing for 2025, in turn underpinning the dollar.

“Our base case is that the dollar will make some further headway next year as the U.S. continues to outperform, the interest rate gap between the U.S. and other G10 economies widens a little further, and the Trump administration brings in higher U.S. tariffs,” said Jonas Goltermann, deputy chief markets economist at Capital Economics.

Ahead of U.S. President-elect Donald Trump’s return to the White House in January, global central banks have urged caution over their rate paths due to uncertainty on how Trump’s planned tariffs, lower taxes and immigration curbs might affect policy.

Goldman Sachs said it was uncertain how tariffs could affect future Fed policy, adding that the inflation impact of price increases should fade after a year.

“The 2018-2019 trade war tightened financial conditions by enough to prompt an easing in Fed policy,” Goldman Sachs added.

“Much about the current cycle is different, but the 2018-2019 experience shows that the monetary policy risks from tariffs are at a minimum two-sided.”

-

Entertainment3 months ago

Entertainment3 months agoMovie Review: Helen Mirren tells a story of evil and hope during WWII in ‘White Bird’

-

Entertainment3 months ago

Entertainment3 months agoDozens of health workers killed in Lebanon over past day, WHO says

-

Business3 months ago

Business3 months agoRay-Ban maker EssilorLuxottica slams ‘grab bag’ lawsuits claiming eyewear monopoly

-

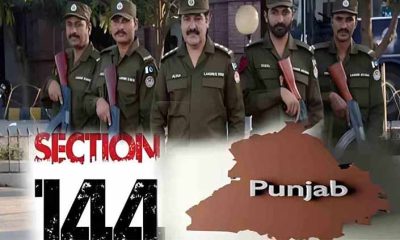

pakistan2 months ago

pakistan2 months agoPunjab govt imposes Section 144 in five districts

-

Business3 months ago

Business3 months agoGold scales fresh record high in Pakistan

-

Entertainment3 months ago

Entertainment3 months agoGoosebumps and stars as Paris Fashion Week kicks off

-

Entertainment2 months ago

Entertainment2 months agoBeyoncé leads the 2025 Grammy noms, becoming the most nominated artist in the show’s history

-

Tech3 months ago

Tech3 months agoExploding pagers pose new threat but your phone is safe, experts say