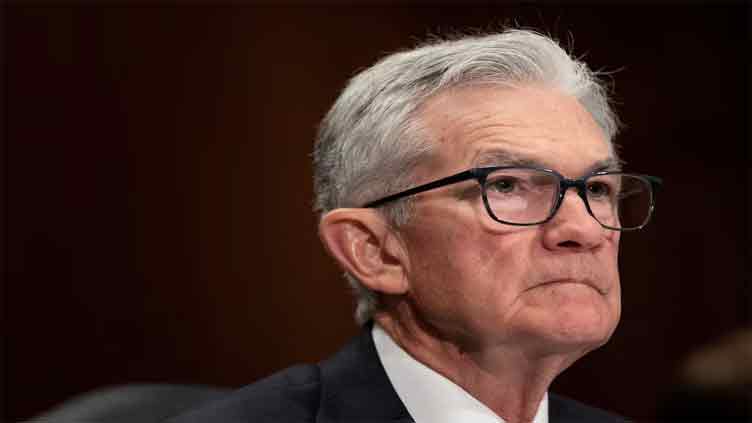

Top US central bank officials including Federal Reserve Chair Jerome Powell backed away on Tuesday from providing any guidance on when interest rates may be cut, saying instead that monetary policy needs to be restrictive for longer and further dashing investors’ hopes for meaningful reductions in borrowing costs this year.

Fed policymakers have said since the start of the year that rate cuts are contingent on gaining “greater confidence” that US inflation is moving towards the central bank’s 2 per cent goal, but readings over the past few months show price pressures may even be moving in the opposite direction.

“The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence,” Powell told a forum in Washington, in what is likely to be his last public appearance before the April 30-May 1 policy meeting.

Read more: Strong US retail sales create fears that there won’t any Fed rate cuts until September

“Right now, given the strength of the labour market and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us,” he said.

US central bankers are universally expected to leave rates unchanged at their upcoming meeting, but until early this month analysts and investors thought rate cuts would likely start with an initial quarter-percentage-point reduction at the Fed’s June 11-12 meeting, with two more cuts happening by the end of 2024.

Now the first cut is expected in September and the odds of a second cut are dwindling.

“If higher inflation does persist, we can maintain the current level of restriction for as long as needed,” Powell said. “At the same time, we have significant space to ease should the labor market unexpectedly weaken.”

In separate remarks earlier on Tuesday, Fed Vice Chair Philip Jefferson omitted any mention of rate cuts, and said the US central bank was ready to keep its tight monetary policy in place “for longer” if inflation fails to slow as expected.

Jefferson noted the central bank was facing a strong economy and had seen little recent progress in bringing down inflation, excluding what had been a staple reference in Fed speeches to gaining “confidence” in lower inflation and then cutting rates.

“My baseline outlook continues to be that inflation will decline further, with the policy rate held steady at its current level, and that the labor market will remain strong, with labour demand and supply continuing to rebalance,” Jefferson said.

In his last public remarks, on Feb 22, Jefferson included what had been a staple of recent Fed communications – that “if the economy evolves broadly as expected, it will likely be appropriate to begin dialling back our policy restraint later this year,” a nod to the possibility of reducing the Fed’s benchmark overnight interest rate from the current 5.25pc-5.50pc range to account for a slowing pace of price increases.

‘MEASURED HAWKISH RESET’

Analysts and investors have been steadily marking down the likelihood and timing of Fed rate cuts as policymakers struggle to reconcile a gravity-defying economy with their assessment that monetary policy is “restrictive” and inflation likely on its way down.

Both of those ideas have been called into question by job growth, retail spending, inflation and other data that continue to challenge the Fed’s sense that the economy was gliding towards lower demand, slower growth, and price increases nearing the 2pc target.

Read more: Dollar rally supercharged by US rate outlook, could complicate inflation fight for other economies

Just over five weeks ago, Powell told a US Senate panel that the Fed was “not far” from gaining the confidence in falling inflation needed to cut interest rates.

Powell not only omitted that characterization on Tuesday, but he also did not repeat his prior view, laid out after the Fed’s March 19-20 meeting, that data in January and February had not changed the “overall story” of gradually slowing inflation.

Instead, he said the Fed’s preferred measure of underlying inflation – the year-over-year change in the core personal consumption expenditures price index – likely rose 2.8pc in March, unchanged from February, with three-month and six-month average measures “actually above that level.”

“We view this as a measured hawkish reset of policy communication to a more neutral posture with less of an immediate bias to cut rates, though the basic idea of wanting to get more confidence inflation is moving lower before cutting rates remains intact,” said Krishna Guha, vice chairman at Evercore ISI.

“But what has not changed is Powell’s read of the underlying economics, and this prevents us from reading him too hawkish overall.”

When US inflation was in fast decline last year, Powell was reluctant to declare the fight against it won even as policymakers laid the groundwork for rate reductions beginning this year.

Officials at the Fed’s March 19-20 meeting said they still expected to cut the policy rate by three-quarters of a percentage point by the end of 2024. Powell at the time said disappointing inflation data in January and February “haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes-bumpy road toward 2pc.”

Yet the bumps continued through March, enough so that some officials at the last Fed meeting worried monetary policy was not having the sort of impact that would be typically expected from the highest US interest rates in a quarter of a century.

Data since then have shown a massive 303,000 jobs were added in March, the pace of consumer price increases accelerated, and even low-income households continued to spend.

The strength of the economy, policymakers suggest, is one reason they could wait to cut rates and be sure inflation will resume its decline.

Post Views: 15

Sports3 months ago

Sports3 months ago

Sports3 months ago

Sports3 months ago

Fashion2 months ago

Fashion2 months ago

pakistan3 months ago

pakistan3 months ago

pakistan3 months ago

pakistan3 months ago

World2 months ago

World2 months ago

Sports2 months ago

Sports2 months ago

World2 months ago

World2 months ago