Tech

Japanese chip venture Rapidus needs $54bn to begin production, says chairman

Tech

Kretinsky and Layani face off in battle for distressed IT firm Atos

Kretinsky and Layani face off in battle for distressed IT firm Atos

Tech

China to build 100-mile-long hyperloop train line by 2035

China to build 100-mile-long hyperloop train line by 2035

Tech

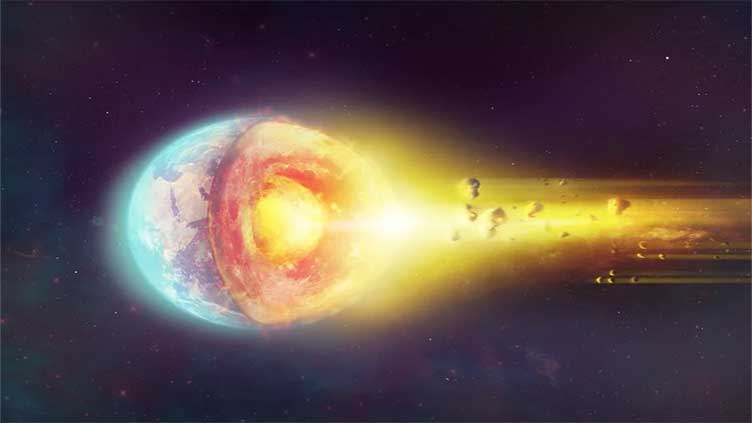

Scientists discover hidden planet buried under Earth’s surface

Scientists discover hidden planet buried under Earth’s surface

-

Sports3 months ago

Sports3 months agoSon and Bissouma ready for Spurs game with Brighton

-

Fashion2 months ago

Fashion2 months agoGiorgio Armani catwalk blooms with florals at Milan Fashion Week

-

Sports3 months ago

Sports3 months agoSinisterra signs long-term deal with Bournemouth

-

pakistan3 months ago

pakistan3 months agoECP rejects Salman Akram’s plea for PTI affiliation

-

pakistan3 months ago

pakistan3 months agoECP convenes emergency meeting today

-

World2 months ago

World2 months agoTaiwan ally Tuvalu names Feleti Teo as new prime minister

-

World2 months ago

World2 months agoTunisia court sentences ex-president Marzouki to 8 years in absentia

-

Sports2 months ago

Sports2 months agoScaled-back opening ceremony for Paris Olympics to offer 326,000 tickets