Uncertainty and “draconian regulations” have drastically raised risks for foreign businesses in China, a report by a European business group said Wednesday.

The lengthy paper by the European Union Chamber of Commerce in China urges China’s leaders to do more to address concerns that it says have “grown exponentially” in recent years.

“This report comes at a time when the global business environment is becoming increasingly politicized, and companies are having to make some very tough decisions about how, or in some cases if, they can continue to engage with the Chinese market,” it says.

The study, compiled by the chamber and the China Macro Group consultancy, echoes concerns that have been raised by European and American companies operating in China. Foreign investment fell 8% last year from a year earlier as companies recalibrated their commitments in the world’s second largest economy.

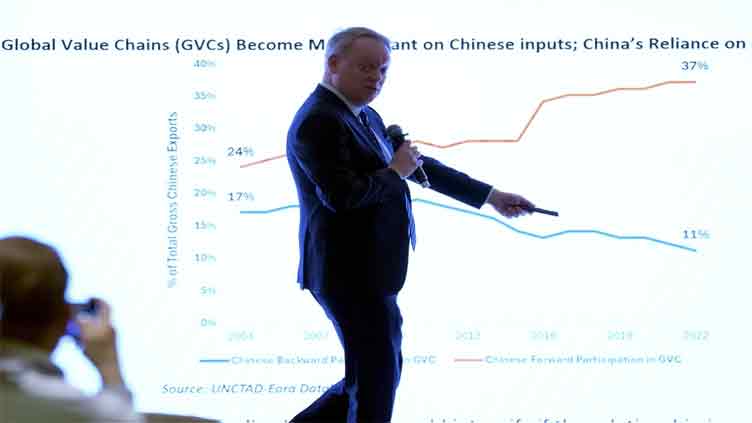

EU Chamber officials said China’s changing business environment partly reflects moves by Beijing to minimize risks due to trade friction and dependence on imports of key commodities or industrial products. That’s especially the case given trade friction with Washington and discussions about “decoupling” supply chains from China after the disruptions that occurred during the COVID-19 pandemic.

But they said European companies also must manage their own risks.

China has sought to emphasize its openness to foreign companies and investment. Its commerce ministry spokesperson said the country was working to ensure 100% access to manufacturing by eliminating remaining trade barriers.

On Tuesday, the State Council, China’s Cabinet, issued an updated version of an action plan announced in July to promote more foreign investment, especially in high-tech areas favoured for growth such as computer chips, biopharmaceuticals and advanced equipment. It promised tariff exemptions and called for stopping practices that discriminate against foreign companies.

But other actions have run counter to that spirit of openness. Raids on foreign businesses in China, unclear state secrets laws and tightening rules on handling of data have generated unease among many foreign business people in the country.

“The number and severity of risks companies find themselves having to navigate has grown exponentially in recent years,” Jens Eskelund, president of the European Chamber in China, told reporters in a briefing before the report’s release.

At the same time, Beijing has not addressed many of the issues raised by foreign businesses, among them access to government procurement contracts, which are vital given the huge role of state-owned companies in the economy.

It’s particularly difficult for medical equipment companies and research and development. Meanwhile, pharmaceutical companies are “quite alarmed by data security regulations that make clinical trials impossible,” said Markus Herrmann Chen, co-founder and managing director of the China Macro Group.

“We are still the odd guys out, and this needs to change,” Herrmann Chen said.

Part of the challenge results from China’s increased focus on national security in terms of reliance on technologies vital to its own industries. In part, such strategies are driven by U.S. moves to cut off business with Huawei Technologies and to prevent sales of leading edge computer chips and the equipment needed to make them.

American companies have expressed similar concerns. Sean Stein, the chair of the American Chamber of Commerce in China, said recently that China has made progress in addressing some issues but not others.

“The business community would like both sides to be much clearer about the definitions of national security and how it’s determined,” he said in an interview before an annual chamber banquet with Chinese officials. “Because what we need is … predictability, and we need certainty.”

One sore point for European business: a Chinese announcement of plans for anti-dumping investigations into three French brandy producers: E Remy Martin & Co, Martell & Co and Societe Jas Hennessy & Co.

“It’s hard to see how 300 euro ($330) bottles of XO can be accused of dumping,” Eskelund said.

For its part, China is unhappy with an ongoing European Union investigation into subsidies for electric vehicles in China and whether they have given Chinese makers an unfair advantage in European markets.

Meanwhile, with regard to cybersecurity, Eskelund said “we’ve seen some very draconian new regulations being published in China.”

He said Europe’s approach to trade and investment issues was “targeted, very limited and very focused on eliminating ‘critical dependencies,’” not at competing with China. But companies still must hedge against risks or potentially be blindsided by policy shifts.

At the same time, companies also face risks in cutting back and must bring their “best game” to China, while others feel too exposed, especially after the shocks of the pandemic, when entire cities were ordered into lockdown and factories suspended production at times.

China’s market has become “less predictable, reliable and efficient,” the report says, partly because the business environment is more politicized.

Eskelund called on China to restore predictability to the regulatory environment.

“Predictability was one of the main things that made China so enormously attractive,” he said. “We might not like everything we saw but we knew what we got.”

He said the purpose of the report is to try to bring the debate over de-risking and national security down to the level of specific industries and commodities so that the various sides are not just hurling big abstract concepts at each other.

“We want to find common ground,” he said. “We want to work with China on these issues. We want to work with Europe on these issues.”

Post Views: 29

Fashion3 months ago

Fashion3 months ago

Sports3 months ago

Sports3 months ago

Sports3 months ago

Sports3 months ago

Fashion2 months ago

Fashion2 months ago

pakistan3 months ago

pakistan3 months ago

World3 months ago

World3 months ago

pakistan3 months ago

pakistan3 months ago

Tech3 months ago

Tech3 months ago